I had a great discussion the other day with Ankit Vashishtha, one of the founders of Nektar.ai. We were talking about the power of emerging RevOps solutions, and he said something I’ve been thinking a lot about – “at the end of the day, it’s about data… not intuition…”. That’s something that’s been at the core of my personal belief system for a long time.

Sales organizations have a long history of relying on intuition in making sales forecasts. How many times have you heard, “I think that deal is about to come in.” or “I think that they are ready to buy.” or “My gut says we’ll hit the forecast this quarter.” or “The deal is pushing to next quarter, but it’s still good – trust me.” If you’ve been around sales organizations for a long time – you’ve heard these statements hundreds or maybe even thousands of times. In my experience - almost every time someone says things like that – the statement is based on intuition and not data – and they’ve been more wrong than right. I’d rather see a business run like a pilot landing at night in Los Angeles – relying on data and input from their systems to land (not just training and intuition about where LA might be and not using the GPS).

This is why there are so many companies focused on getting the right data at the right place at the right time for sales organizations to make smarter decisions. Salesforce continues to add key functionality into their product to improve forecasting, third parties like Clari, Aviso, and Gong are investing and innovating to bring the best possible insights to sales leaders. New companies like Nektar.ai are working to solve data challenges in your tech stack. I’ve been speaking with a few other stealth startups recently that are looking to provide dramatically improved visibility into the core operations for RevOps teams. There’s a lot of great stuff out there and coming – this industry is going to change a lot in the next few years.

Why is this so important? It’s the data. It’s the right data. At the right place. At the right time. One of the biggest challenges companies face is getting their sales organizations to truly adopt the tools properly into their daily workflow and leverage the data available to them. How many companies do you know that have invested heavily in tools and they are implemented but mostly just “sit there?”. We (as an industry) need to make sure we’re investing in people and process change – not just the tools – if we want to really succeed. Driving real process change is a topic for another discussion in the future.

Let me give you an example from my past where intuition and data told two different stories. This example is around deals that push (and push, and push…). We all have deals that push for a variety of reasons. We had two sales segments (SMB and Enterprise) and I asked the sales leaders of each – “I see we keep pushing a significant number of deals out in the last two weeks of the quarter. Are those going to close?” The answer I always got was “oh yes – they are just about to close – we just need a few more days. They’ll close in the first week or two of the next quarter.” The first week rolls around. Nothing. The second week comes to a close and still nothing. I looked at these deals and now they are pushed out to the end of the current quarter.

As we dug into the data – here’s what we found. There were a number of deals in both segments that kept pushing: 4,5,6,7,8,9+ times and the sales team refused to let the deals die. They wanted to keep them in the pipeline to show activity and coverage. Bet you’ve never seen that problem before in your sales org. 😉

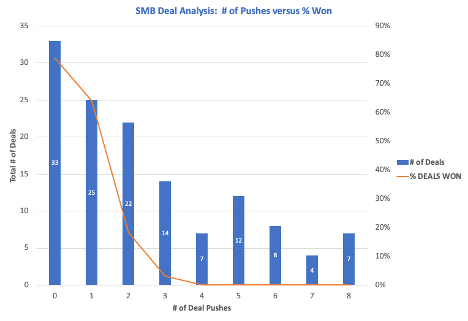

Here’s an analysis of the SMB business looking at the number of deals closed won % by the number of pushes that each deal had. You can see that the % of deals won is pretty high when the deal doesn’t push (or pushes only once) – and then it drops off extremely quickly. Out of the 132 deals analyzed, 38 of them (29%) had pushed 4 times or more and based on our analysis will likely never close. So we worked with the sales teams to automatically close deals that push more than three times. They didn’t like it – but it made the forecasting and pipeline coverage a lot more accurate.

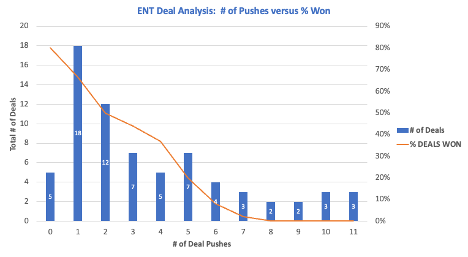

It was a little bit different with Enterprise deals. The complexity of those deals meant that more of those pushed more often and would still close – but we found that after four pushes our odds of closing started dropping pretty significantly (below 40%). At 7 pushes the odds of closing was low single digits (around 2%). So we made a rule that said anything more than 4-6 pushes we’ll forecast at a maximum of 20% and anything after that never made the forecast – it was pure upside if it came in.

Again – the whole point of this is to look at data – not just intuition. I’m not saying to discount all intuition – but business decisions (especially sales forecasts) need to be grounded in data. People hadn’t been looking at pushes when making their intuitive judgments – just gut feelings around the deals.

Anyhow – what have you seen? There are tons of metrics we could have looked at for examples but this one stood out based on the conversation earlier in the week.

As always – closing with a picture of Ollie. He’s waiting patiently for a generous portion of steak…

Feel free to reach out with any topics or questions. Until next time.

Best,

Steve